Preparation Before Access

Update Time:2025.12.311. Select Access Mode

Before accessing, merchants/institutions should first determine the access mode applicable to the registration areas of their companies. WeChat Cross-Border Pay currently provides three access modes: direct connection mode, institutional mode, and common service provider mode.

1.1. Direct connection mode

Merchants are directly connected to the WeChat Cross-Border Pay interface, and WeChat Pay settles the transaction amount with the merchants. Currently this access mode is only available in Hong Kong and Britain. For specific access procedure and qualification requirements, refer to the direct connection mode onboarding instructions.

1.2. Institutional Mode

In the institutional mode, the acquiring institution connects to the WeChat Pay API and provides the secondary encapsulation interface for the merchants. WeChat Pay settles the transaction amount with the acquiring institution, and the acquiring institution settles the transaction amount with the merchants. At present, this access mode can be used in all areas where WeChat Cross-Border Pay is available, and it is also the main connection method of WeChat Cross-Border Pay. For specific access procedure and qualification requirements, refer to the institutional mode onboarding instructions. If you would like to know the acquiring institutions in your area that has cooperated with WeChat Pay, click to view it.

1.3. Common service provider mode

In the common service provider mode, the common service provider connects to the WeChat Pay API and provides the secondary encapsulation interface for the merchant. The common service provider processes the transaction information flow only, and does not touch the cash flow. The transaction amount will be settled directly with the merchant. Currently this access mode is only available in Hong Kong. For specific access procedure and qualification requirements, refer to the common service provider mode onboarding instructions.

Select the access mode according to your actual situation and your country or region.

2. Application Guidelines

1. Applying for merchant ID mch_id

When onboarded in WeChat Pay, all institutions or direct merchants need to apply for a collection account first, which is mch_id. The application address is as follows: Merchant ID Application Guidelines

After a merchant ID is applied for successfully, WeChat Pay will send a notification email to the contact email box filled in by the institution, including the mch_id successfully applied for and login account password. Please keep them properly. An example is as follows:

|

2. Applying for APPID

As all the product systems of WeChat Pay are built on the WeChat social system, when direct merchants or institutions access WeChat Cross-Border Pay, a WeChat social carrier is also needed, and its corresponding ID is APPID.

At present, the social carrier of institutions can only be an official account. Please apply for an official account through the following link: Official Account Application Guidelines

After an official account has been applied for successfully, the institution can log in to the official account platform to obtain the corresponding APPID. The specific directory for viewing is Development > Basic Configuration > Official Account development information, as shown in the figure below. Usually, one institution only needs to apply for one official account.

|

3. Binding MCHID and APPID

After both APPID and mch_id have been applied for, the binding relationship between them needs to be established.

The institution can log in to the merchant platform and select Dev Configuration on the top tab to enter the binding operation page. If the platform prompts that the binding has failed, contact the corresponding BD or assistant to complete the binding.

In the institutional mode, multiple mch_id can be bound under one APPID, and one mch_id can be bound to numerous APPID.

4. Sub-merchant onboarding

After the above steps are completed, the sub-merchant onboarding permission will be opened to the institution.

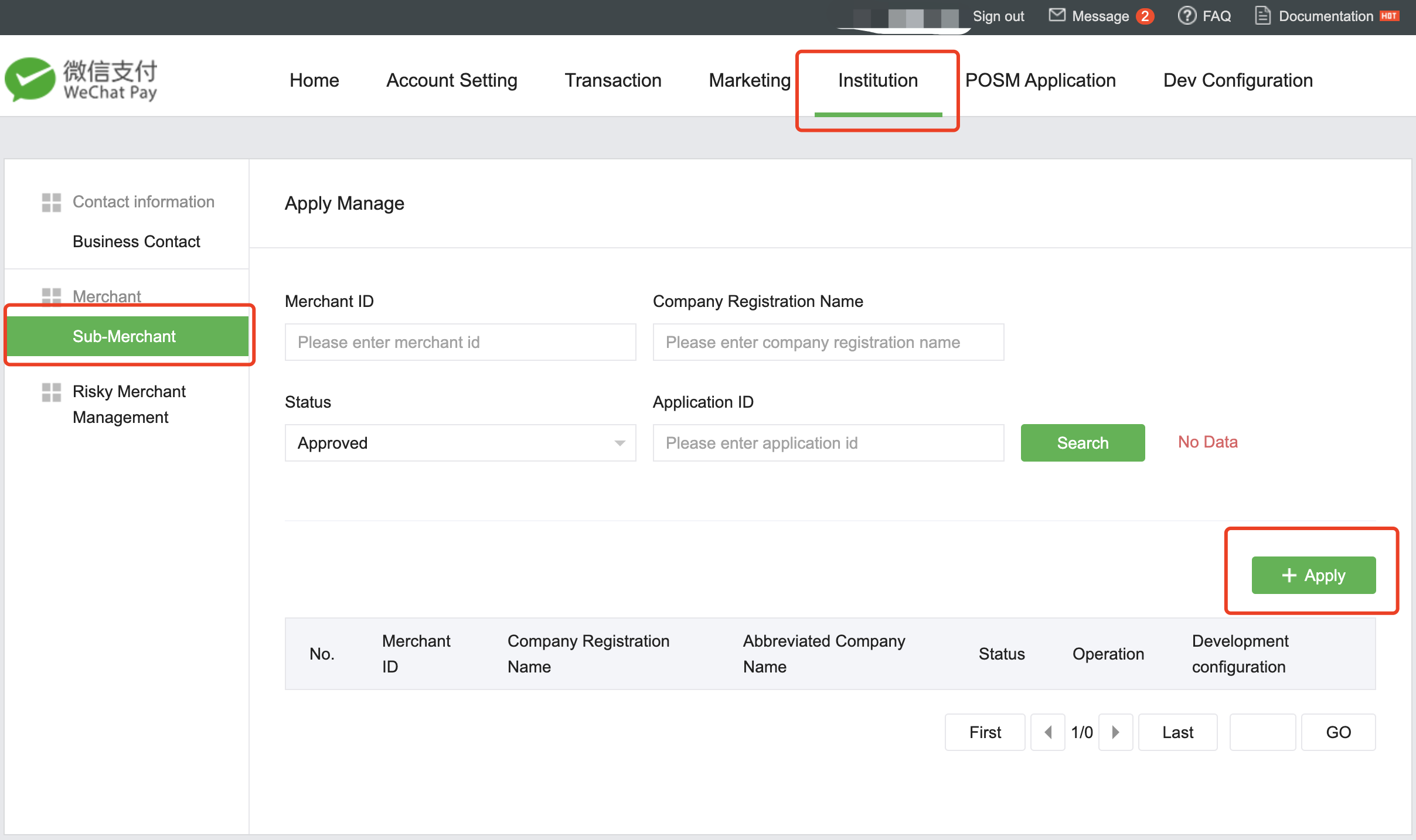

Institutions can log in to the merchant platform and enter the Institution interface to complete the onboarding of sub-merchants, or use the onboarded sub-merchant API to complete the onboarding.

5. Confirming that the field of the direct merchant/sub-merchant is allowed to access auto debit payment and possesses the following qualifications

Field | Open Standards |

|---|---|

Internet sharing/leasing of portable charger | The following three conditions must be met at the same time:

|

Public utilities (water, electricity, gas, heating, etc.) | |

Intelligent freezer | |

Phone bill | |

Transportation | |

Online content platform |

6. Signing a supplementary agreement with WeChat Pay after permission is granted

7. Applying for a auto debit payment template to get the template ID

The auto debit payment template is the only parameter assigned by WeChat Pay to merchants to access password-free payment. Please keep the template properly after getting it.

WeChat Pay manages each deduction service in the dimension of template, which consists of the following elements:

Field Meaning | Service name (displayed to users) | Diagram |

|---|---|---|

Template ID | The unique ID assigned by WeChat Pay, used as a necessary parameter for development connection. |

|

Service name (displayed to users) | It is determined through joint consultation between the institution, merchant, and the operator and enables users to understand the auto debit payment service. |

|

Service description (displayed to users) | It is determined through joint consultation between the institution, merchant, and the operator. The merchant introduces the auto debit payment service to the merchant so that users can better understand the content of the auto debit payment service. |

|

Termination callback URL | The termination callback URL is provided by the direct merchant/acquiring institution/common service provider. |

|

8. Finish

3. Configure Development Parameters

3.1. Configuring API Key v3

WeChat Pay API Key v3 is used to encrypt and decrypt sensitive information in interface transmission. For specific encryption and decryption rules, refer to Encrypting and Decrypting Sensitive Information.

Follow the steps below to configure API Key v3:

1. Log in to WeChat Merchant Platform, select Account Settings > API Security >Set APIv3 Secret, and click Set APIv3 secret.

2. Enter API Key v3, which consists 32 characters, including numbers and upper and lower case letters. Click Confirm to go to the next step.

3. Enter set pin code to get the SMS verification code. Enter the verification code and click OK to complete the settings.

4. Click Confirm to exit the dialog box.

5. Finish

3.2. Downloading and configuring the merchant certificate

The merchant certificate is used for signing and signature verification during content transmission by institutions/direct merchants.

Institutions can log in to WeChat Merchant Platform, and select Account Settings > API Security > API Certificate to download the certificate.

Follow the steps below to download the certificate:

1. At the end of 2018, the newly onboarded institutions and merchants of WeChat Pay started to use the certificates issued by the CA. Click Manage on the certificate application page,Then click "Apply" on the new page.

2. Click the Download button in the pop-up window to download the certificate tool.

3. Install the certificate tool and open it. Select the path where the certificate needs to be stored and click Request Certificate.

4. Select Apply API Certificate > Observer Certificate Signing Request in the pop-up window on the merchant platform, and click click here to copy the merchant information.

5. In the certificate tool, paste the copied merchant information and click Next.

6. Get the request string.

Step 1 In the certificate tool Copy request string, click Copy to copy the request string.

Step 2 Select Apply API Certificate > Obtain Certificate Signing Request in the pop-up window on the merchant platform, paste the request string into the input box.

Step 3 Select Apply API Certificate > Obtain Certificate Signing Request in the pop-up window on the merchant platform, enter the SMS verification code and login password.

Step 4 Select Apply API Certificate > Obtain Certificate Signing Request in the pop-up window on the merchant platform, click Next to enter the Get certificate page.

7. Getting the certificate string

Step 1 Select Apply API Certificate > Get Certificate in the pop-up window on the merchant platform, click Copy to get the certificate string.

Step 2 In the certificate tool Copy request string, click Next to enter the Paste certificate string page.

Step 3 In the certificate tool Paste certificate string, click Paste to paste the certificate string copied from the pop-up window on the platform.

Step 4 In the certificate tool Paste certificate string, click Next to generate a certificate.

8. In the certificate tool Generate certificate, this page indicates that the certificate has been applied for successfully.

Click View folder to open the path where the certificate is saved to verify the certificate.

9. Finish